In-kind donations can be a great alternative to cash donations for nonprofits and their donors. This guide to In-kind donations for nonprofits will give you the knowledge and tools you need to get started with accepting in-kind donations for your nonprofit. Everything from what are in-kind donations to receipting policies and accounting for in-kind donations.

What Are In-Kind Donations

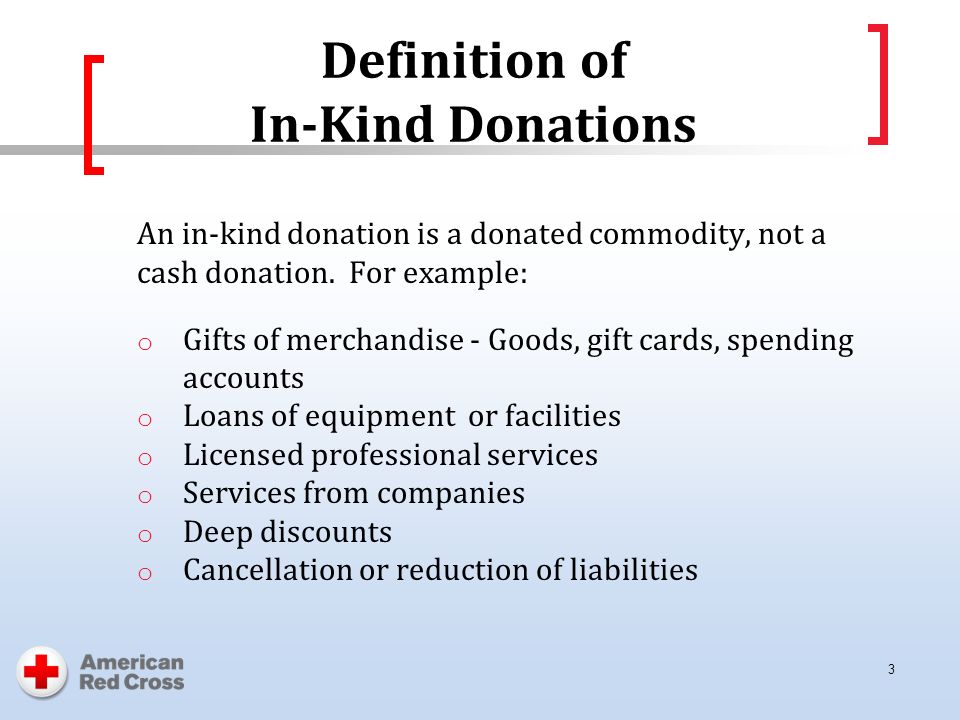

In-kind donations are non-cash gifts made to nonprofit organizations. In-kind donations for nonprofits can be made by individuals, corporations, and businesses. Some examples of in-kind donations are:

- Physical items like sports equipment, food, office supplies

- Services like pro-bono consulting, repair work

- Copyright and intellectual property like being able to use an artist’s music royalty free

- In-kind donations can include software licenses a nonprofit CRM software or accounting software

What Qualifies as In-Kind Donations

In the simplest terms, an in-kind donation is any donation that your nonprofit receives that isn’t monetary (cash, stocks, bequests, etc.), this means that the category of in-kind donations is very broad.

Goods or products

Physical goods or products are most likely what comes to mind when you ask “what are in-kind donations?”

Some examples of in-kind donations that are physical goods:

- Clothing and shoes

- Toys and school supplies

- Food

- Equipment or office supplies

Intangible in-kind donations

While less obvious than physical items, services and other intangible things can be in-kind donations for nonprofits.

Some examples of intangible in-kind donations:

- Rent-free space

- Consulting or other services

- Repair work and manual labour

Copyrights and Intellectual Property

This may be one of the least obvious forms of in-kind donations when you think about “what are in-kind donations?” but copyright and intellectual property can be very valuable in-kind donations.

- Even copyrights and intellectual property can be in-kind donations like a musician allowing you to use their music royalty free

Are In-Kind Donations Right for Your Nonprofit?

However, the category of in-kind donations is quite broad, so even if more obvious in-kind donations, like physical goods, aren’t right for your nonprofit doesn’t mean you can’t benefit from in-kind donations.

In this section of the guide, we’ll go over which type of in-kind donation can most benefit different nonprofit organizations.

Goods and products

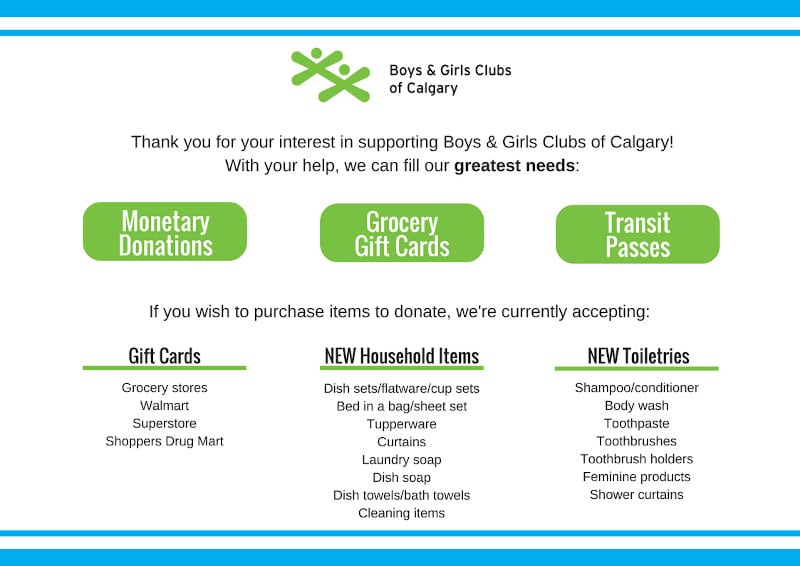

In-kind donations that are physical items will be useful for organizations that work directly with the community they are serving like community centres, shelters, food banks, and clinics.

Some great in-kind donations for these nonprofits would be

- Toys and games for kids

- Clothing and shoes

- Personal care items for care packages

- First aid and medical supplies

This doesn’t mean nonprofits that don’t work directly with their community can’t benefit from in-kind donations. That is far from the case!

Almost any nonprofit can benefit from donated office supplies and equipment like gently used computers or office furniture.

Think about your big events could you use any in-kind donations as prizes for raffles or auction items, or could you use a donation of bottled beverages and packaged snacks for your peer-to-peer walk and run events to keep people hydrated and fed.

Intangible in-kind donations

If your nonprofit doesn’t have a lot of direct contact with your community consider in-kind donations that are not tangible.

- Rent free space for your next meeting or event

- Donated services like consulting

- Royalty free music for your next awareness video

Any nonprofit can benefit from intangible in-kind donations in one form or another as the category is so broad.

What Nonprofits Need in Order to Accept In-Kind Donations

Before you begin accepting in-kind donations for your nonprofit, there are some regulations you’ll need to be familiar with, and some processes you’ll want to set up at your nonprofit for accepting in-kind donations.

Gift acceptance policy for accepting in-kind donations

You may already have a gift acceptance policy for cash gifts that offers guidelines to your nonprofit staff on what they can take gifts for and who from. You need a gift acceptance policy like this for in-kind donations as well.

A gift acceptance policy for in-kind donations will help your nonprofit ensure that the items or services you receive are useful for fulfilling your nonprofit’s mission, and not something that will take up extra space or create a burden on your staff.

This policy is there to protect your nonprofit and set clear guidelines for your staff when it comes to accepting in-kind donations for your nonprofit, but it’s also a good policy for your donors.

Your in-kind donations acceptance policy sets clear expectations for your donors and ensures that their generous in-kind donations are put to the best use, and not left sitting in a storage room. And it makes it easier for your staff to turn down in-kind donations that are not a good fit without making the donor feel that their offer was meaningless to the nonprofit.

Your nonprofit’s gift acceptance policy for in-kind donations is going to be very specific to your needs and mission, but here are some thought starters for what to include in the policy:

- Do items like toys, clothing or equipment need to be new or will your nonprofit accept gently used items?

- Any specific items you will not accept like used baby items such as car seats as they may not be safe to use?

- Whether or not your nonprofit will accept food, and if you will, are there certain requirements like peanut free or nonperishable food items?

- Requirements you have for your in-kind donation donors, such as not accepting donations from companies that produce or sell tobacco or alcoholic beverages?

Tax rules and receipting policies for in-kind donations for nonprofits

Before you start accepting in-kind donations for your nonprofit, you should familiarize yourself with the appropriate tax rules and regulations.

The rules you need to follow will vary depending on your country, in this guide to in-kind donations for nonprofits we’ll go over the Internal Revenue Service (IRS) rules for the United States and the Canada Revenue Agency (CRA) rules for Canada.

Are in-kind donations eligible for tax deductions?

- The IRS allows for in-kind donations to qualified organizations to be tax deductible

- There are specific forms donors need to fill in to claim their charitable giving, more information from the IRS can be found here

- CRA does allow registered charities to issues receipts for in-kind donations where the donation is a physical item or property

- See the CRA definition of property here

- The receiptable amount of a non-cash gift must be based on the fair market value (FMV)

- Donations of service cannot be claimed when a donor files their taxes, as donated services are not eligible to receive a tax receipt

- However, the service provider and nonprofit can do what is called a cheque exchange. The nonprofit will pay the service provider and then the service provider will donate that money back to the nonprofit

In addition to these national regulations, you may also want to check if there are any specific rules in your province or state for accounting for in-kind donations.

Make sure you read up on the rules and regulations that your nonprofit needs to follow. If you are unclear on any of the rules and regulations regarding in-kind donations check with your finance department and your legal team to ensure your nonprofit is covering all the bases.

Accounting for in-kind donations

It’s not only fundraisers who will need to be aware of the tax rules and regulations, it’s important you ensure your finance team is knowledgeable in these policies and prepared to be accounting for in-kind donations.

Here are few of the processes you’ll want to work out with your finance team for accounting for in-kind donations.

- Calculating and understanding fair market value

- As long as the in-kind donation does not exceed the amount at which a professional appraisal is recommended. CRA recommends a formal appraisal on in-kind donations valued over $1,000

- What in-kind donations are, and are not, eligible to be receipted

- Properly recording in-kind donations as revenue or property for your financial statements

- Accounting for in-kind donations in your nonprofit’s revenue goals and reporting

Documenting in-kind donations

You will also need to have a process in place to record in-kind donations along with the donor information. Just like cash donations, in-kind donations should be logged in a donor’s record in your nonprofit database, like Sumac.

- Understand how you will record in-kind donations in a donor record

- What information about the gift will you include in your CRM

- How will you use your CRM to facilitate any stewardship or required reporting back to the donor

How to Ask For In-Kind Donations

Fundraising for in-kind donations for your nonprofit is not so different from fundraising for monetary donations. You may already have some donors in mind to solicit for in-kind donations, and you’ll likely be able to find prospects through your nonprofit’s network.

Starting the conversation

Depending on the type of in-kind donations you’re looking for you will have different target audiences. Here are a few groups you may want to reach out to and how you can approach the conversation.

Senior leadership and your board

- Get started by introducing the concept of in-kind donations and providing your gift acceptance policy for in-kind donations for their review

- Do some networking with your board and senior leadership to see if anyone has connections with prospects who could give an in-kind donation

Corporate partners

- Your current corporate partners are good prospects for in-kind donations, as long as what they can offer your nonprofit falls within your gift acceptance policy for in-kind donations

- Start the general conversation by sending over your gift acceptance policy for in-kind donations and ask if they’d be interested in this kind of contribution

- If you know you have good corporate prospects for in-kind donations, and have in mind what you’d like to ask for, make a more tailored pitch with a case for support

Current donors and community members

- If you’re seeking smaller scale in-kind donations like gently used items from the community or a toy drive you can reach out to your current supporters

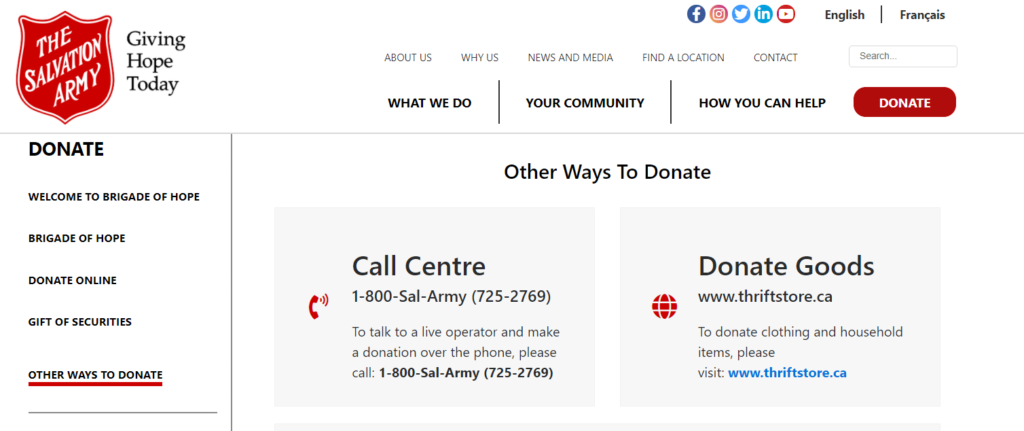

- Promote in-kind donations anywhere you promote monetary donations, in your direct mail packages, on your website, social media, and in your newsletter

The Salvation Army has included in-kind donations for their thrift store in their Other ways to donate section so prospective donors can easily find the information:

Communicating the need

When you’re talking about in-kind donations it can be very easy to focus on the “what” especially when you are speaking with corporate partners. But don’t forget to focus on the “why”.

The reason that your nonprofit needs these in-kind donations, and the impact they will have, is just as important.

- Frame the need to your donors focusing on their opportunity to have an impact

- Make an emotional, story driven appeal so your in-kind donation prospective donors feel connected to the cause

- Focus on the outcome of the in-kind donation rather than the item itself

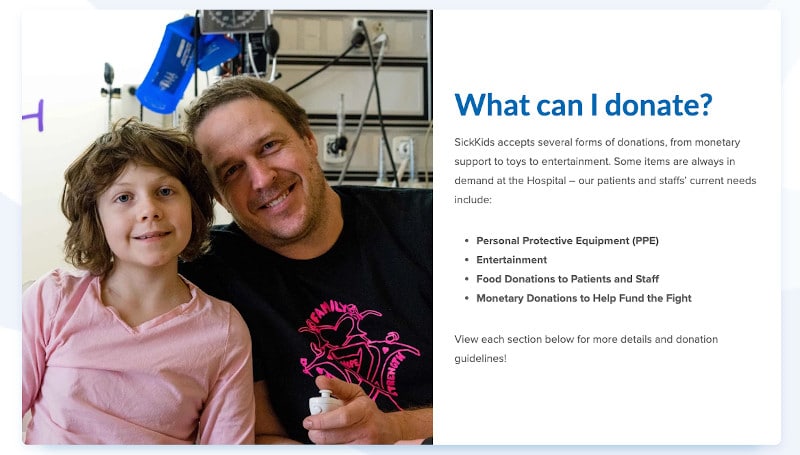

See how SickKids includes their important policies, but also communicates the need and the impact of in-kind donations.

Acknowledging and stewarding in-kind donations

Stewardship for in-kind donations can be just like your stewardship for cash donations! Make sure you’re sending the donor a thank you letter, and if applicable a receipt or written acknowledgement, in a timely fashion.

- Set up a stewardship journey for in-kind donation donors

- With Sumac CRM you can set up reminders for important steps

- Depending on the value of the in-kind donation this could include anything from a personalized thank you letter to a phone call from your CEO

- Consider recognizing in-kind donations anywhere that you recognize cash donations

- Donor walls

- Annual reports

- On your nonprofit’s website

- Follow-up with the donor to give an impact report on their in-kind donation and its impact

With this guide to in-kind donations for your nonprofit you’re all set to start exploring this exciting new revenue stream! And it’s just one more way that your generous donors can help support your mission.

.png)